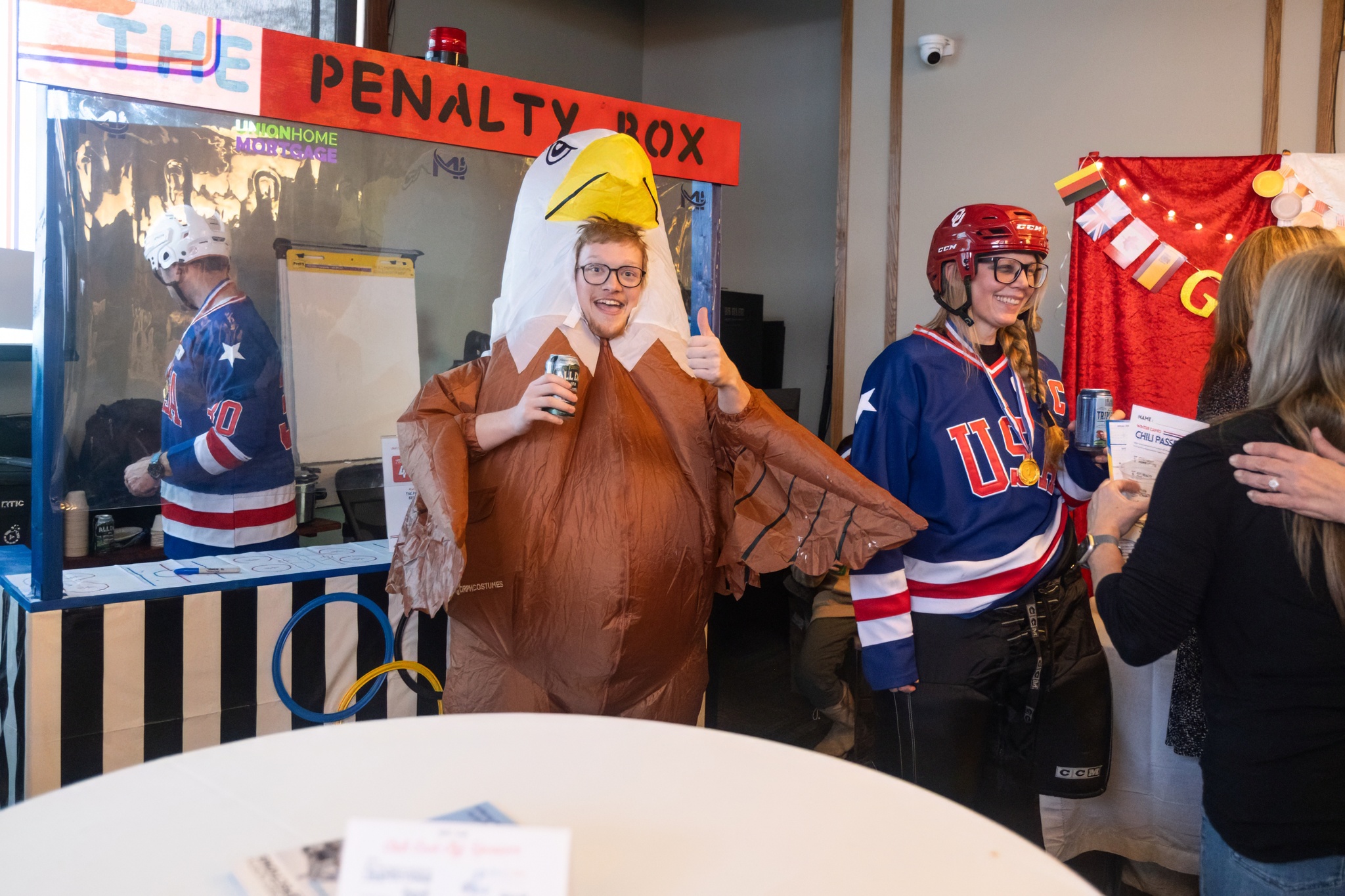

On February 26th, 2026, Aspire North Realtors brought the heat during our Winter Olympics–Themed Chili Cook-Off, welcoming members and guests for an afternoon filled with great food, friendly competition, and community connection. From creative themes to bold chili recipes, the event was a delicious success!

Celebrating Our 2026 Winners:

A huge congratulations to this year’s winning teams who impressed both our judges and attendees with their outstanding chili creations:

- 1st Place: RE/MAX Bayshore

- 2nd Place: One Trust Home Loans

- 3rd Place: Union Home Mortgage

- Best Theme: Union Home Mortgage

- People’s Choice Best Chili: RE/MAX Bayshore

The competition was fierce, and every team brought something unique to the table. Thank you to everyone who participated and helped make this event such a fun and flavorful experience!

Thank You to Our Judges

Selecting winners was no easy task, and we are incredibly grateful to our distinguished panel of judges who took on the delicious challenge:

- Judy Shoemaker – Marketing leader and former Director of Marketing for the 2002 Salt Lake City Winter Olympics

- Les Eckert – Nationally renowned culinary educator, former Executive Pastry Chef for Marriott International, and Director of the Great Lakes Culinary Institute

- Lauren Tucker – Executive Officer of the Home Builders Association of Northwest Michigan

Their expertise, enthusiasm, and thoughtful judging helped make the event even more special.

A Unique Olympic Connection

This year’s Winter Olympics theme brought an extra touch of excitement to the cook-off. Guests even had the chance to see an authentic piece of Olympic history, the Official Olympic Torch Runner’s Uniform.

A special thank you goes to Rachele, owner of Tinker Tailor in Elk Rapids, for generously lending us “Olympia,” the mannequin used to beautifully display the uniform during the event. It was a fantastic addition that helped bring the Olympic theme to life.

Thank You to Our Sponsors

Events like the Chili Cook-Off wouldn’t be possible without the generous support of our sponsors. We extend our sincere appreciation to:

- Serra Traverse City

- Genisys Mortgage Professionals

- MI Home North Inspections

- BlueLaVaMedia, LLC

A special thank you to BlueLaVaMedia, LLC for also capturing incredible photos throughout the event so we can relive all the fun and memorable moments.

Bringing Our Community Together

The Aspire North Chili Cook-Off is more than just a competition, it’s an opportunity for our members, affiliates, and community partners to come together, connect, and celebrate the relationships that make our organization so strong.

Thank you to everyone who attended, cooked, judged, sponsored, and supported this event. Your enthusiasm and participation are what make gatherings like this so memorable. We’re already looking forward to seeing what creative recipes and themes next year will bring!